What Does Fit Stand For On A Check Stub

If you work for a company that uses a fiscal year instead of a calendar year that means its accounting period ends on a date.

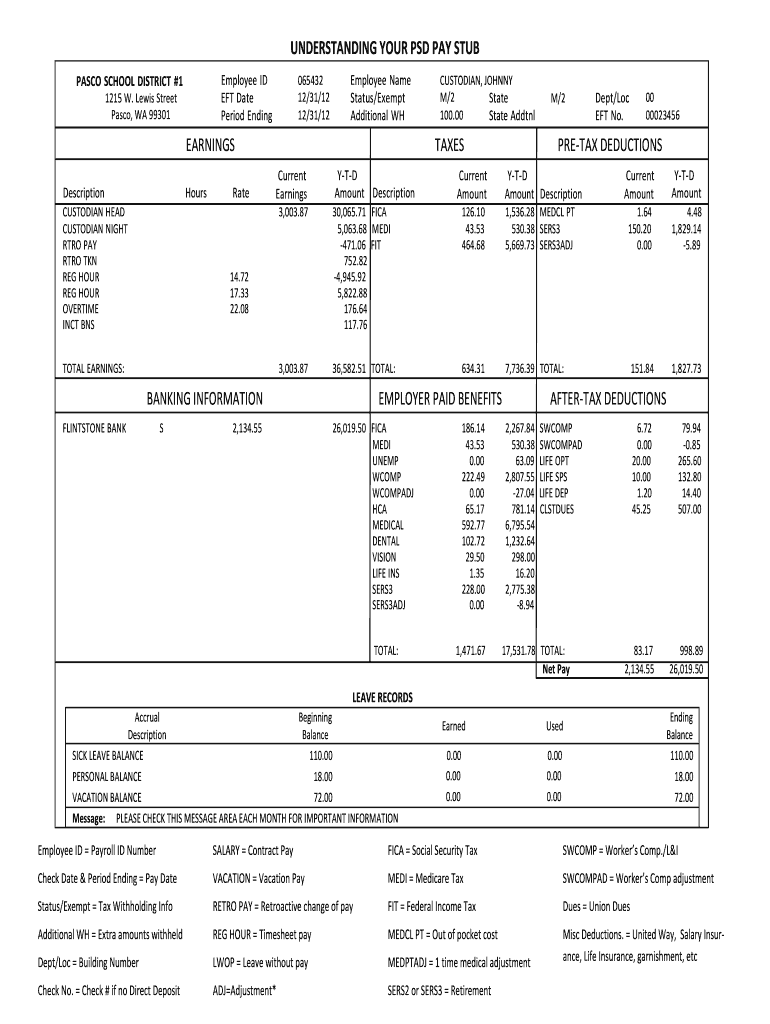

What does fit stand for on a check stub. The rate is not the same for every taxpayer. Fica is an acronym for federal insurance contributions act fica tax is the money that is taken out of workers paychecks to pay older americans their social security retirement and medicare hospital insurance benefits. These items go on your income tax return as payments against your income tax liability. Fit fed income tax sit state income tax.

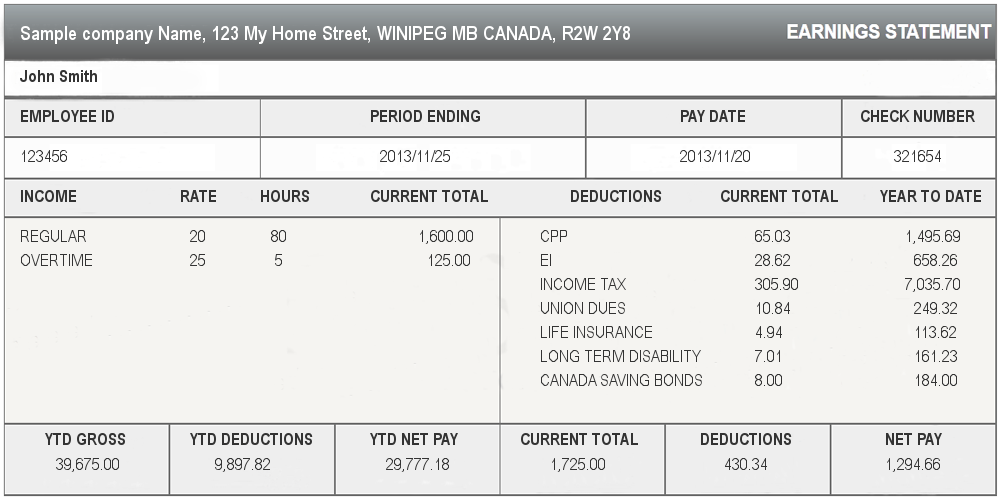

This includes not just regular pay but possibly also vacation pay or even administrative leave. It is separate from fica taxes and requires a different calculation method. In the united states federal income tax is determined by the internal revenue service. Fit is applied to taxpayers for all of their taxable income during the year.

However when an employee comes to you questioning how much you took out of her check and why. Some are income tax withholding. Earning abbreviations show where your money is coming from. Fit stands for federal income tax.

What do the abbreviations stand for on the back of payroll checks. Understanding how your federal income tax affects your gross and net pay is absolutely critical for all working taxpayers today. Ssn social security number. Fica is easy to compute because it is based on flat percentage of your wages.

Not sure what fic is there should be an fica which is the federal insurance contributions act or social security. One of the benefits of utilizing a payroll service is that it saves you from worrying about the details associated with issuing pay and withholding taxes. Ein employee identification number similar to your social security number pay stub earning abbreviations. On most pay stubs there will be a figure showing your year to date ytd earnings.

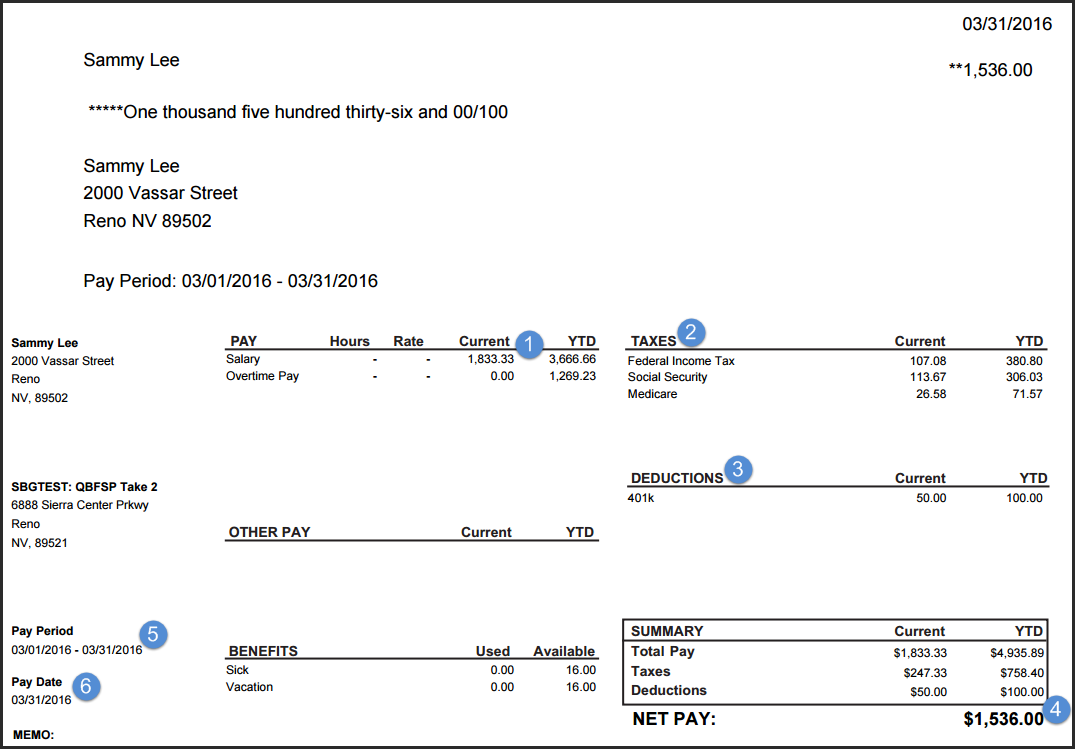

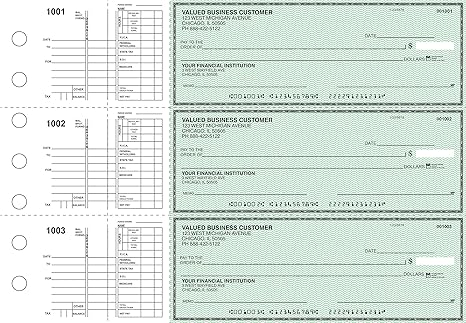

If you see the fit deduction listed on your paycheck s earning statement it is an acronym for federal income tax. They are all different taxes withheld. This is the amount of money an employer needs to withhold from an employee s income in order to pay taxes. A pay stub can be a confusing piece of paper.

Fica would be social security and medicare which are not deductions nor credits on your income tax return. Federal income tax withholding depends on the irs withholding tax tables your taxable wages and the marital status and number of allowances stated on your form w 4. With this information you can prepare for tax season.